Using Random Assignment in Pricing Research Studies

A basic problem with both Stated Willingness-to-Pay and the Price Sensitivity Meter is that they are asking people to nominate prices. The issue is that people find these questions to be difficult to answer because we typically react to prices while we are shopping and not things we nominate in surveys.

So, the basic method that is used in pricing research is to ask questions that closely mirror the real world. If your questions are more consistent with prices that are presented in real life, then we have a better chance of getting better data, which in economic jargon is called ecological validity.

So, the approach to our fifth technique, Random Assignment, is called Buy or Not Buy. With this method, you would provide a description of the product as if they would or would not buy a product. The more realistic the question the better, so in markets with many competitors like the consumer goods market, you can make your questions more realistic by adding specific competitors into the question.

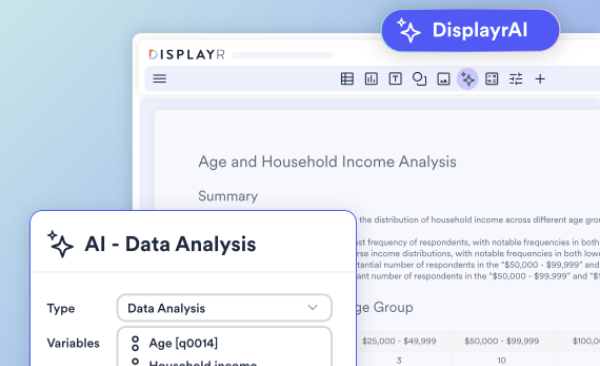

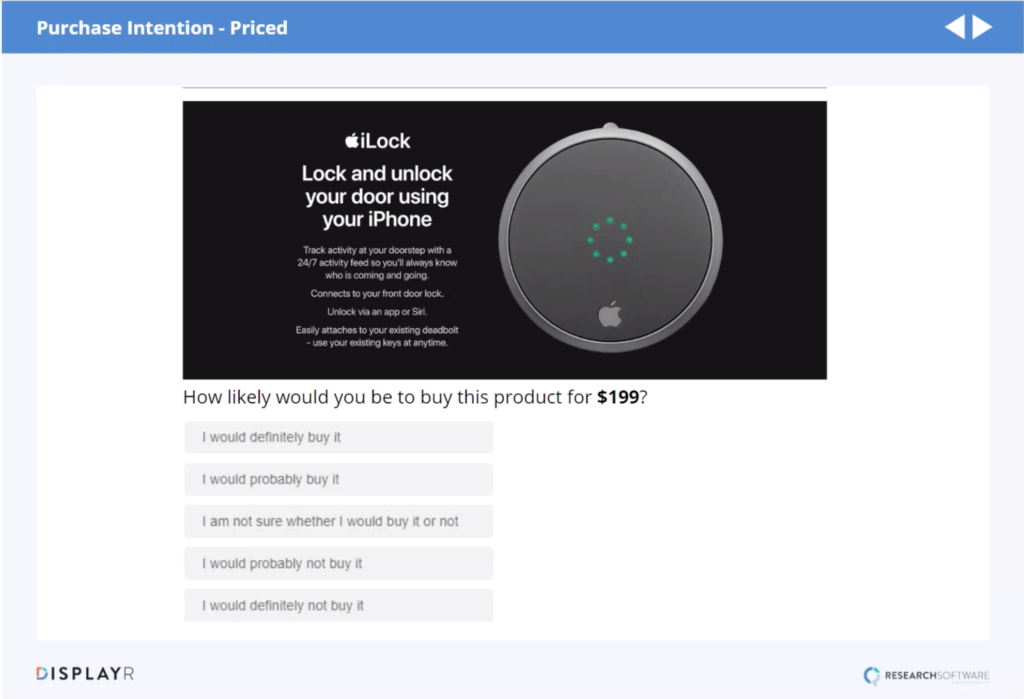

However, most market researchers don’t like that style of question, they instead like to use a different approach called Purchase Intention. Typically, researchers use weighted survey questions to find out how much people prefer to pay. This type of question would ask someone if they would buy a product at a certain price using a scale. See the image below.

With questions such as these, you get different groups of people who were asked the same questions, but each answer varies by price point. From these questions, we can create a demand curve in order to find the preferred price, just like in our third approach Stated Willingness-to-Pay.

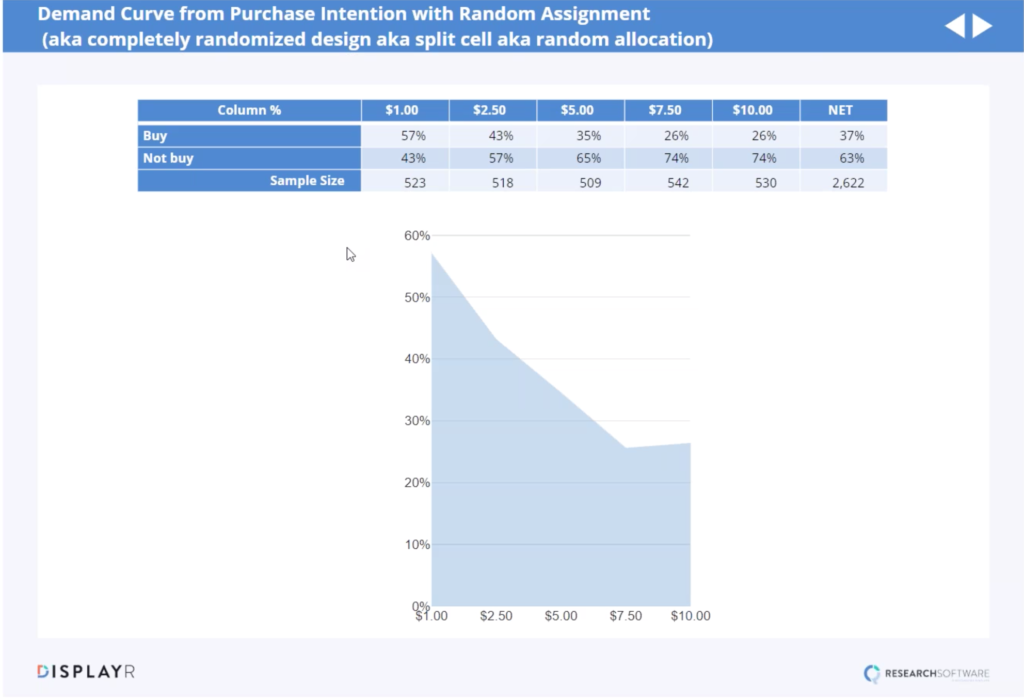

For example, below is a table and chart from a cable TV study where we were trying to work out how much more to charge for a bundle of new TV channels. In this study, we tested five different price points among 2,622 people. The advantage of this approach is that our data is more reliable because the questions are realistic, but the disadvantage is how expensive interviews are for a sample size that large. And even with such a big sample, there can still be problems with the data such as a sampling error between the different price points.

For example, this analysis shows that people were indifferent between paying $7.50 and $10 for the new TV channel bundle. So, if you used the demand curve for profit optimization it will likely end up recommending pricing at $10, which can be an issue because this conclusion could likely be based on a sampling error. And because the issue of a sampling error can arise with these types of questions, most market researchers will often use the Choice-Based Conjoint Technique.

For more examples on the other pricing research techniques see: Price Salience, Price Knowledge/Awareness, Stated Willingness-To-Pay, Price Sensitivity Meter, Choice-Based Conjoint.